With the COVID-19 pandemic, we have witnessed an unprecedented moment in history that has impacted the entire globe at a never before seen scale and at a blazing pace. This coronavirus has resulted in a double black swan event where there is a health and financial pandemic at the same time.

After our January 2020 Market Outlook, Sensex & NIFTY touched all-time highs. In March, they witnessed an extreme crash ~38%. Since then we have seen a recovery of a little above 38% but we are still over negative 10% from the January 2020 levels.

On the Road to Normalcy

Global Bonds have already fully recovered their losses

Global Equities have regained almost 2/3rd of their losses

A combination of easy monetary and easy fiscal policy has opened the floodgates for easy money in the global economy

Central Bankers are hoping that money supply will spur growth

Global Indices have picked up

Sectoral Indices in India picking up with Banking & Finance staying strong

Urban India is trying to reach normalcy despite all the constraints

Unemployment Rate is getting much better than what we saw in April & May

A credit growth decline from 15% to 6% shows that we are at the bottom of the business cycle, in a good position for future growth

Second Consecutive Month of FII Inflows in June are in line with global liquidity and indicate return to normalcy and interest in India Equity

Markets discount for the future, and right now, the markets have discounted a couple of positives – if actual events turn out to be better than what is discounted by the market, prices will rise from here, if actual events turn out to be worse, markets will correct. Some of the things that markets have discounted are –

An early return to normal activities based on a medical solution which is around the corner (based on vaccines that are in trial or sheer optimism).

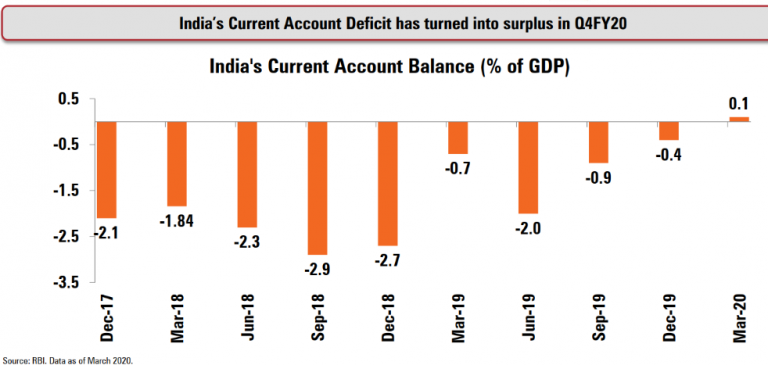

Current Account surplus in India – drop in oil imports, gold imports, trade deficit with China

Healthy Forex Reserves

Current Account Deficit has turned into surplus

3. Expected GDP growth for FY21 will be negative BUT for FY22 will rebound very well courtesy economic packages announced by the Govt & RBI.

System Liquidity in Surplus via RBI Rate Cuts

From a valuations point of view, Current Equity Valuations are still very reasonable for long term investment

The market cap to GDP ratio is 71% which is lower than the historic average of 77%

Excluding the top 10 stocks of Nifty 50, the valuations are very reasonable

The small cap space looks attractive from a valuations point of view indicating that we may see a broad based recovery going forward

This article is based on various on data from various sources (mentioned wherever possible) including ICICI & Kotak Mutual Fund Reports

Comments